HPL surveyed industry journalists and asked their opinions about on betting trends in 2023

Key takeaways

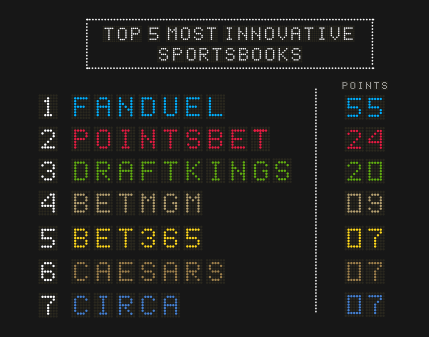

- FanDuel is the clubhouse leader when it comes to innovation

- Fanatics new sportsbook is believed to be primed to takeoff in 2023

- Experts anticipate in-play betting will become the new industry hook

HPL Digital Sport are part of the Hot Paper Lantern family, specializing in the sports betting environment by assisting companies to create greater brand relevance in a constantly evolving marketplace.

The team at HPLDS recently carried out a study amongst industry-focused journalists, focusing on the operators that are getting it right and why, topics of innovation, as well as their thoughts on the media’s perceptions and how this may or may not match the business realities of the industry.

When it came to naming the top operator, FanDuel was the runaway winner when it came to innovation. Respondents were asked to rank their top three choices which they awarded three, two and one point respectively. FanDuel more than doubled the score of second-place finisher PointsBet.

The commentary from the survey experts shed further light onto why they believe that FanDuel left the competition far behind in this particular category. They stated “they do well what was necessary these past few years in order to attract users – easy user experience (UX) overall and amazing promos.” Further adding “once other operators catch up and have just as good UX, they will lose some of this unique appeal. However, FanDuel does control a sizable part of the market and that won’t just go away overnight.”

Arguably the most interesting takeaway from the survey regards the much-anticipated arrival into the market of Fanatics at some point in 2023. The excitement from the media is clear for all to see as their entrance into the market ranked as the top story of the year for 2022 with 21% of the vote. This was followed by the Disney (ESPN) teaser announcement of an upcoming strategic partnership with DraftKings with 17%, followed by DraftKings integration with Amazon’s Thursday Night Football package at 13%.

In 2021, owner Michael Rubin announced that he would be creating Fanatics Sportsbook but it took until May 2022 for the Fanatics Sportsbook name to be officially trademarked, signaling that the sports betting operation had finally been given the green light. Yet, here we are, still awaiting their arrival some two years later. But why?

Speaking with Ed Moed, CEO and Co-Founder of Hot Paper Lantern, we asked why they think it is taking Fanatics so long to bring their betting offering to market when, on the surface at least, they appear to be ready to go?

“Now that the market has begun to mature (some), sports betting companies are really taking a closer look at their capabilities, technology and communications and making more strategic decisions regarding entering and launching in specific markets.”

The sports betting marketplace has become much easier to understand as we’ve watched successes and failures over the last 18 months. If a product isn’t unique and compelling and if the user experience is clunky, users will move on to other offerings they like better, as was evident with the decline and fall of Fubo and MaximBets in late 2022.

Moed added, “Fanatics likely hasn’t launched because its team learned from the mistakes of other sportsbooks in the market. Fanatics has capital, a well respected, highly visible brand and a tremendous amount of market interest riding on its success. I believe it is moving forward with caution by continually perfecting its product, technology and overall experience to get it right before officially launching.”

With the money being pumped into the BetFanatics platform, it’s highly unlikely that their app will disappoint. Fanatics had long been in talks to potentially purchase the Tipico sports betting platform, although the deal looks to have fallen through, with Fanatics having supposedly entered into talks with BetParx as of January.

Fanatics are believed to have signed a letter of intent to buy the sportsbook but a deal hasn’t yet been reached and a deal price has yet to be learned. Whoever it is that they acquire, there is still plenty of reason to believe BetFanatics will be a top-tier sportsbook based on all the moves they are making in the lead-up to launch.

As of this moment, the Fanatics Sportsbook is currently available at its flagship retail location at FedExField in Maryland and has been approved for mobile sports betting licenses in Maryland, Massachusetts and Ohio.

With regards to the other brands to watch, the media commentators believe that whilst Fanatics is understandably the “big” news, that people are underestimating the Disney/ESPN partnership. They noted “Disney is being discounted because everyone is unsure how they would actually do it, etc. But they are literally the 800 pound gorilla in this instance, similar to if (say) an Apple or Google said they were getting into the space. If they figure it out, it will cause seismic change in the industry.”

The final question put to the journalists was regarding what innovation will create the most market momentum in 2023, which yielded some interesting answers. The overwhelming majority (42%) voted for in-play betting however, other responses included the gamification of betting, a universal wallet and micro-betting.

We asked Mr.Moed what he believes, aside from in-play betting, will be the next big thing that could pique the interest of the betting community. ”We’re very intrigued to see which of the sportsbooks can create a solid loyalty points or omnichannel rewards platform. Sportsbook loyalty is an extremely fickle notion.“ He continued “our last study in 2021, ‘State of the Industry: User Expectations vs. Executive Realities,’ found the average American sports bettor uses between 2-3 sportsbooks, while anecdotally we know most bettors will promotion shop multiple books for the best deals.”

Giving more information about the introduction of a loyalty based platform, Moed expressed “Loyalty points and rewards have become a signature program for companies like American Express, Starbucks and United Airlines. The sportsbooks that can create similar schemes, earning discounts and services from retail and hospitality partners for example, will capture an extremely sought after contingent of the market – the casual and less price conscious bettor. The sportsbooks that develop the right formula will certainly draw a lot of attention.”

While in-play betting is currently the more popular choice among the media, the vast difference between content, universal wallet and gamification highlights how expansive the bettor experience will be in the coming years.

When it comes to creating new UX for its users, the individual operators need to adopt stronger and more unique, new offerings and could do so by partnering with savvy technology providers, then in doing so, will be able to offer more solutions and products that their customers want to use.